Predicting Fraudulent Claims from Accidents using Deep Learning - Part 1

Introduction

In today’s fast-paced world, insurance fraud has become a significant concern for insurance companies globally. Fraudulent claims not only lead to financial losses but also tarnish the reputation of insurers and increase premiums for honest policyholders. Among various types of insurance fraud, detecting fraudulent claims stemming from accidents poses a unique challenge due to the intricate nature of accidents and the diverse factors involved.

Traditional methods of fraud detection often rely on manual investigation and rule-based systems, which are time-consuming, labor-intensive, and may not be effective in uncovering sophisticated fraud schemes. However, with advancements in technology, particularly in the field of artificial intelligence and machine learning, insurers now have powerful tools at their disposal to combat insurance fraud more effectively. This blog post is divided into 2 parts, in Part 1, we experiment with different algorithms, and in Part 2 will develop and deploy a web-based App based on the results obtained in Part 1

Data description

The insurance claim dataset contains information related to various insurance claims filed by policyholders. It includes details such as policyholder demographics, accident details, policy information, and claim outcomes. The dataset comprises the following columns:

Month: Month in which the claim was filed.

WeekOfMonth: Week number within the month when the claim was filed.

DayOfWeek: Day of the week when the claim was filed.

Make: Make of the vehicle involved in the accident.

AccidentArea: Area where the accident occurred.

DayOfWeekClaimed: Day of the week when the claim was reported.

MonthClaimed: Month when the claim was reported.

WeekOfMonthClaimed: Week number within the month when the claim was reported.

Sex: Gender of the policyholder.

MaritalStatus: Marital status of the policyholder.

Age: Age of the policyholder.

Fault: Fault attribution for the accident (e.g., policyholder, third party).

PolicyType: Type of insurance policy.

VehicleCategory: Category of the vehicle involved in the accident.

VehiclePrice: Price range of the vehicle.

FraudFound_P: Binary indicator for whether fraud was found in the claim.

PolicyNumber: Unique identifier for the insurance policy.

RepNumber: Representative number associated with the claim.

Deductible: Deductible amount for the claim.

DriverRating: Rating assigned to the driver involved in the accident.

Days_Policy_Accident: Number of days the policy has been active at the time of the accident.

Days_Policy_Claim: Number of days the policy has been active at the time of the claim.

PastNumberOfClaims: Number of claims filed in the past by the policyholder.

AgeOfVehicle: Age of the vehicle involved in the accident.

AgeOfPolicyHolder: Age of the policyholder.

PoliceReportFiled: Binary indicator for whether a police report was filed for the accident.

WitnessPresent: Binary indicator for whether a witness was present at the accident.

AgentType: Type of agent handling the claim.

NumberOfSuppliments: Number of supplementary items included in the claim.

AddressChange_Claim: Binary indicator for whether there was a change of address associated with the claim.

NumberOfCars: Number of cars involved in the accident.

Year: Year in which the claim was filed.

BasePolicy: Base policy associated with the claim.

ClaimSize: Size of the insurance claim.

Initial EDA

Let’s know our data by performing some explorations. We start by looking at the general overview of the data; the dimension of the data, the data types of the various columns, missing values, etc. This gives us an idea of what to expect and the necessary pre-processing. Assuming you read and save your data in a variable called Data, we can peek into the first few rows by doing this in Python

Data.head()

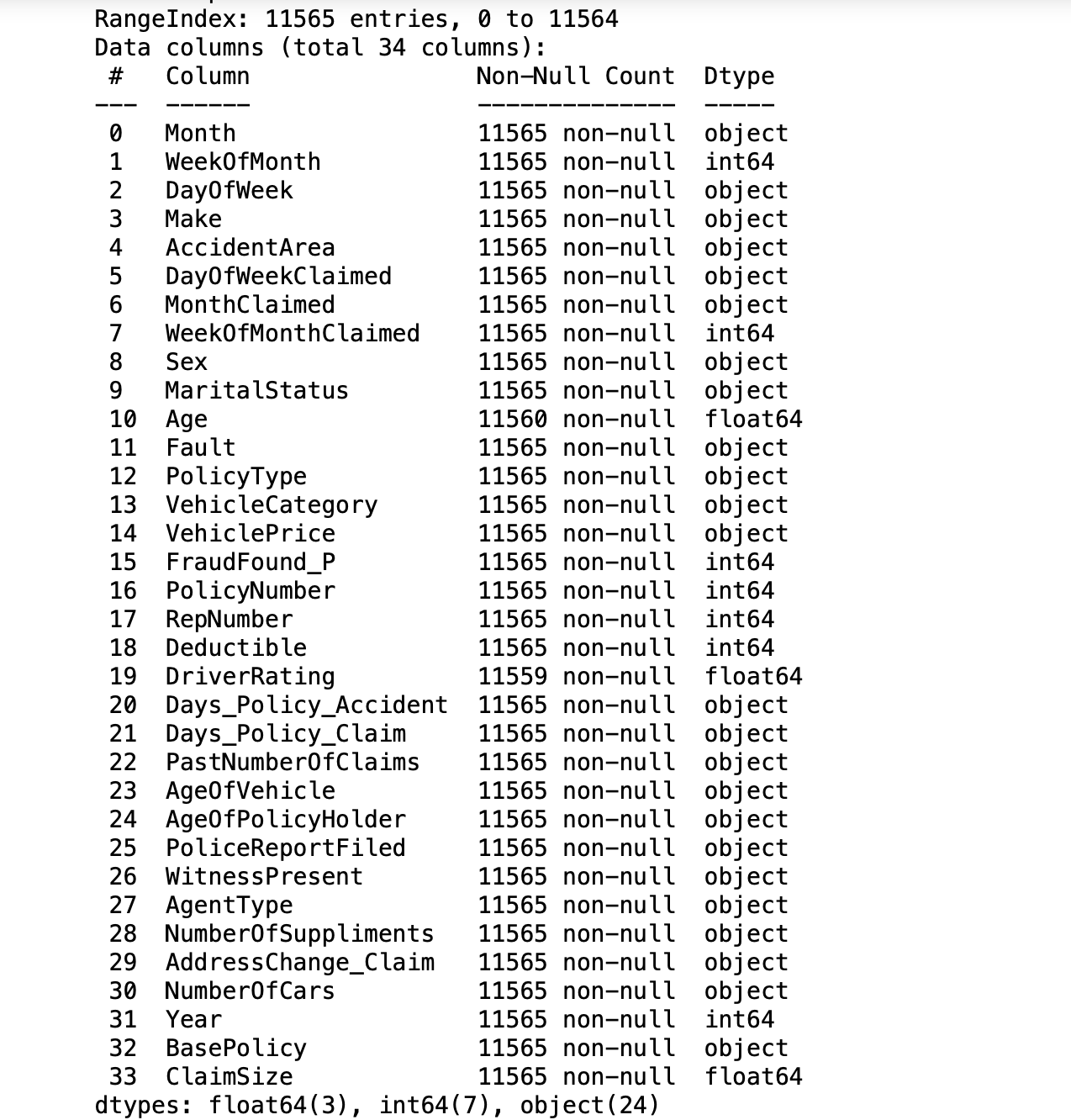

This operation gives us the first 10 rows of the data(Mostly there is little to see at this point). Next, the data.info() gives us an overview of the data as seen below

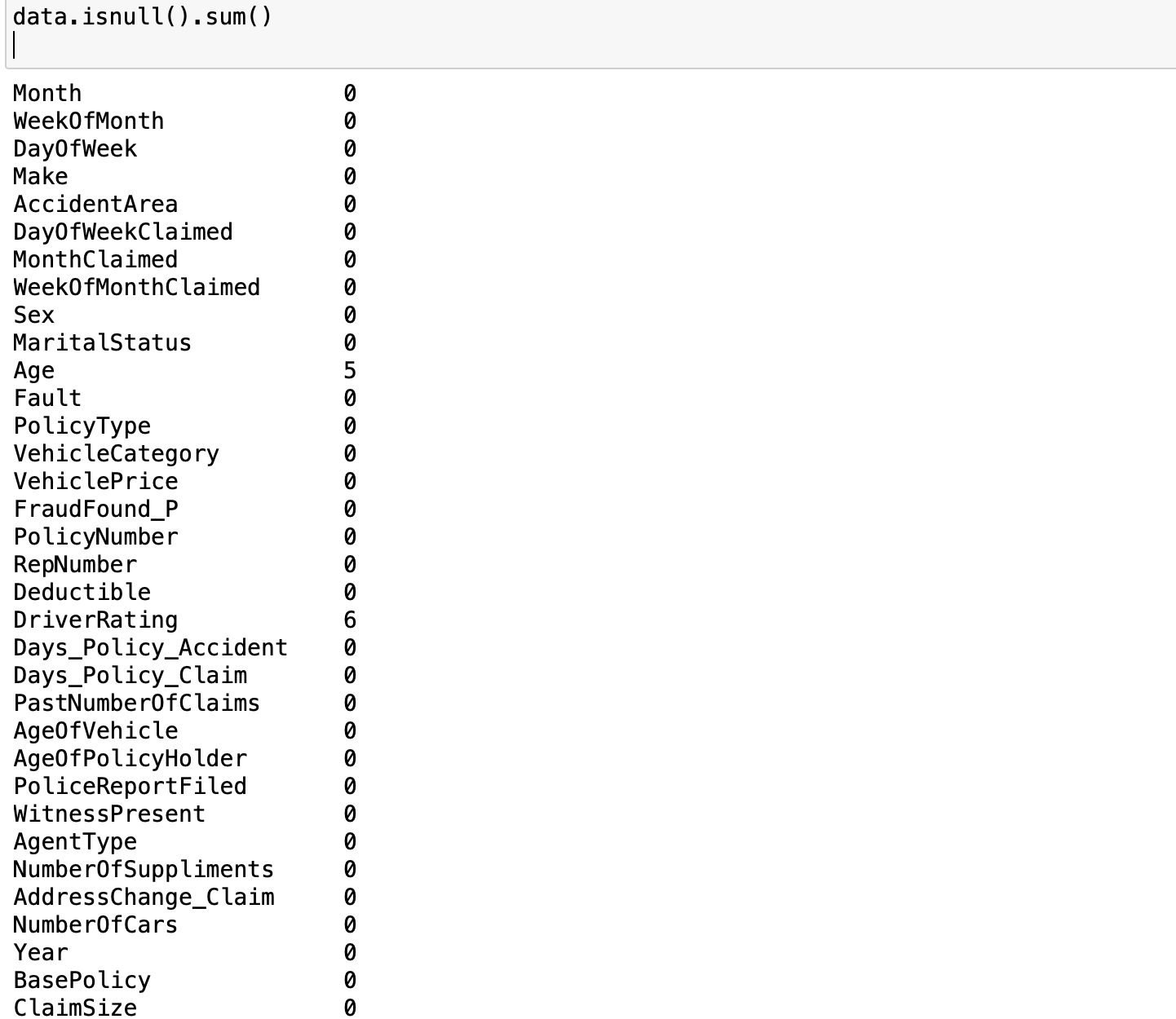

Looking at the result of the operation data.info, we can tell that there are 11565 data points with 34 columns. Out of these columns, 3 of them are of float type, 7 are integers and the rest 24 are objects. Furthermore, we can observe some missing values in some columns, specifically, there are missing values in Age and DriverRating. How many missing values are in these columns? we can find them out by this operation data.isnull().sum()

As we can see there are 5 missing values in Age and 6 missing values in DriverRating. It is a good thing that there are only a few missing values in the dataset). However, irrespective of this small number of missing values, we cannot proceed with our modeling without addressing this issue. We have to decide whether we are going to keep these data points or drop them(we will come back to this later). We examine the distribution of the target variable to understand the class balance in our task. Since our goal is to classify a claim as either legitimate or fraudulent, the target variable is FraudFound_P. FraudFound_P is a binary indicator for whether fraud was found in the claim or not (i.e 0 if there is no fraud and 1 if there is fraud). This

As we can see there are 5 missing values in Age and 6 missing values in DriverRating. It is a good thing that there are only a few missing values in the dataset). However, irrespective of this small number of missing values, we cannot proceed with our modeling without addressing this issue. We have to decide whether we are going to keep these data points or drop them(we will come back to this later). We examine the distribution of the target variable to understand the class balance in our task. Since our goal is to classify a claim as either legitimate or fraudulent, the target variable is FraudFound_P. FraudFound_P is a binary indicator for whether fraud was found in the claim or not (i.e 0 if there is no fraud and 1 if there is fraud). This (data['FraudFound_P'] == 1).sum() gives us the number of fraudulent claims whiles (data['FraudFound_P'] == 0).sum() gives us the number of legitimate claims. The results of the two operations show there are 10880 legitimate claims and only 685 fraudulent claims (not too surprising). In order words, only ~6\% of our datasets are fraudulent If you think about it, most of the claims filed will naturally be legitimate only a few will be fraudulent, same ideology can be extended to receiving spam emails. Most of your emails will be genuine and only a few will be in your spam folder. This phenomenon introduces us to what we call imbalanced data. Generally, if you have a split ratio of 90:10 in the variable of a binary classification, this is pretty obvious that the dataset is imbalanced

As you’ve already seen, a data imbalance is a classification problem where there is an unequal distribution of classes within the dataset.

As you will later see in this tutorial, we must handle the case of imbalances in the data. In the next section, we prepare our data for modeling including fixing the missing values, handling the class imbalance, converting column types into the appropriate types for the chosen algorithms etc

Data preparation and pre-processing

The first thing we want to address is that of the missing values. I have decided to keep these records, hence I need to choose an appropriate method to fill in these missing values (in the Age and DriverRating columns). I can impute these missing values using the mean, mode, or median values of the variable. I can also forward-fill or backward-fill with the last known or next value in that column.

This snippet data = data.fillna(method='ffill') shows that I’ve decided to forward-fill the missing values in my dataset.

Next, I want to change non-numerical datatypes to their numerical numerical representation. For instance, this data["Sex"] will give us a Male, Female, Female kinda response. What I want is to have them as binary responses 1 for male and 0 for female, you get the idea. The function below will help us achieve our desired results;

def convert_to_numerical(data):

for col in data.select_dtypes(include=['object']).columns:

unique_values = data[col].unique()

value_map = {value: i+0 for i, value in enumerate(unique_values)}

data[col] = data[col].map(value_map)

Calling the function convert_to_numerical on our data like this convert_to_numerical(data) will ensure that all non-numerical columns have been assigned their numerical representation. Doing this data["Sex"] will now give us 1,0,0 as desired.

On the issue of class imbalance, we can address it by either of the following; oversample the minority class, undersample the majority class, cost-sensitive learning, etc. Now will be a good time to handle the class imbalance, on second thought however, to understand the effect of the class imbalance in the dataset, we will continue to train and fit our model without addressing the imbalance constraint for now.

Model training

We start with a simple logistic model, where FraudFound_P is our target variable, and the rest of the columns as our predictor variables. Note that if we so desire, we can start with a simple confusion matrix to understand the relationship among the predictor variables and possible dimension reduction to include only needed features. However, this approach is not so necessary in our case as we will be employing deep learning for feature engineering, and we need to understand how each of the features will contribute to our final model We start with a simple logistic regression(with the class imbalance), as below;

#Logistic regression

from sklearn.model_selection import train_test_split

from sklearn.linear_model import LogisticRegression

from sklearn.metrics import confusion_matrix, accuracy_score

# Define features and target variable

X = data.drop(columns=['FraudFound_P'])

y = data['FraudFound_P']

# Split data into training and testing sets

X_train, X_test, y_train, y_test = train_test_split(X, y, test_size=0.2, random_state=42)

# Standardize features

scaler = StandardScaler()

X_train_scaled = scaler.fit_transform(X_train)

X_test_scaled = scaler.transform(X_test)

# Train logistic regression model with class weights

model = LogisticRegression()

model.fit(X_train_scaled, y_train)

# Make predictions on test data

y_pred = model.predict(X_test_scaled)

# Evaluate model performance

# Accuracy

accuracy = accuracy_score(y_test, y_pred)

print(accuracy)

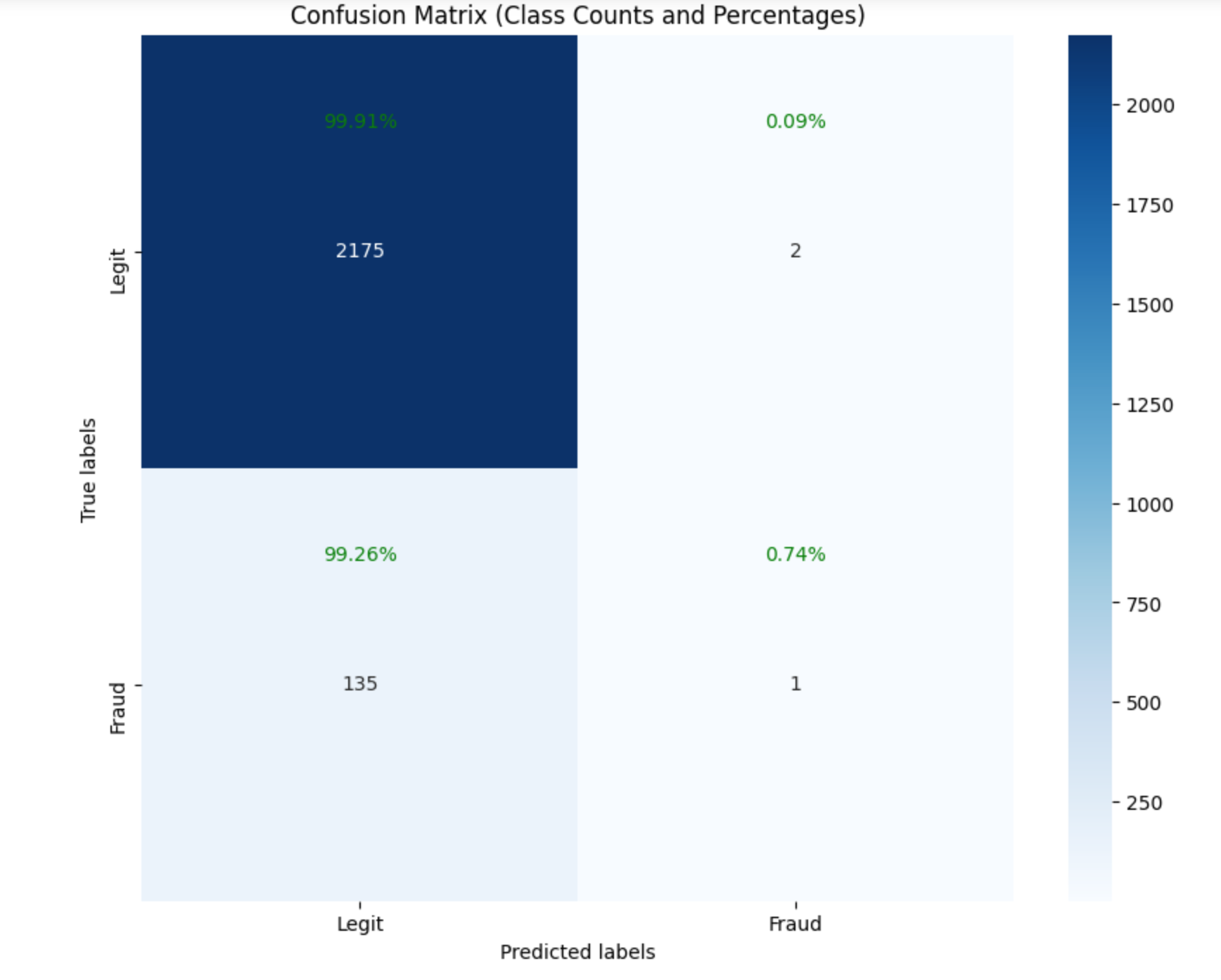

The model has an accuracy of 94.07%. Not to be too happy, we inspect the class performance. We compute the confusion matrix to understand the performance of the model beyond the high accuracy

# Calculate confusion matrix

cm = confusion_matrix(y_test, y_pred)

class_names = ['Legit', 'Fraud']

# Plot confusion matrix

plt.figure(figsize=(8, 6))

sns.heatmap(cm, annot=True, cmap='Blues', fmt='g', cbar=False, annot_kws={"size": 14},

xticklabels=['Predicted 0', 'Predicted 1'], yticklabels=['True 0', 'True 1'])

plt.xlabel('Predicted Label')

plt.ylabel('True Label')

plt.title('Confusion Matrix')

plt.xticks(ticks=np.arange(2) + 0.5, labels=class_names)

plt.yticks(ticks=np.arange(2) + 0.5, labels=class_names)

plt.show()

Observing the results of the confusion matrix from our model, it is clear that our model is doing well in predicting legitimate claims(99.9%) of the time. However this is not our task, our goal is to predict fraudulent claims which our model is so horrible at predicting (0.74%). The model is skewed toward the majority class, therefore despite the 94% accuracy recorded, our model has failed to solve the intended task.

Observing the results of the confusion matrix from our model, it is clear that our model is doing well in predicting legitimate claims(99.9%) of the time. However this is not our task, our goal is to predict fraudulent claims which our model is so horrible at predicting (0.74%). The model is skewed toward the majority class, therefore despite the 94% accuracy recorded, our model has failed to solve the intended task.

To